2020 CUPE 543 EXECUTIVE BOARD RUN OFF ELECTION RESULTS JULY 13, 2020

2020 CUPE 543 EXECUTIVE BOARD RUN OFF ELECTION RESULTS JULY 10, 2020

2020 CUPE 543 EXECUTIVE BOARD RUN OFF ELECTION RESULTS JULY 10, 2020

2ND VICE PRESIDENT (50% PLUS ONE NEEDED TO WIN)

Kelly Poisson 220 54.5%

Christine White 184 45.5%

VOTES CAST:

July 10 2020 404

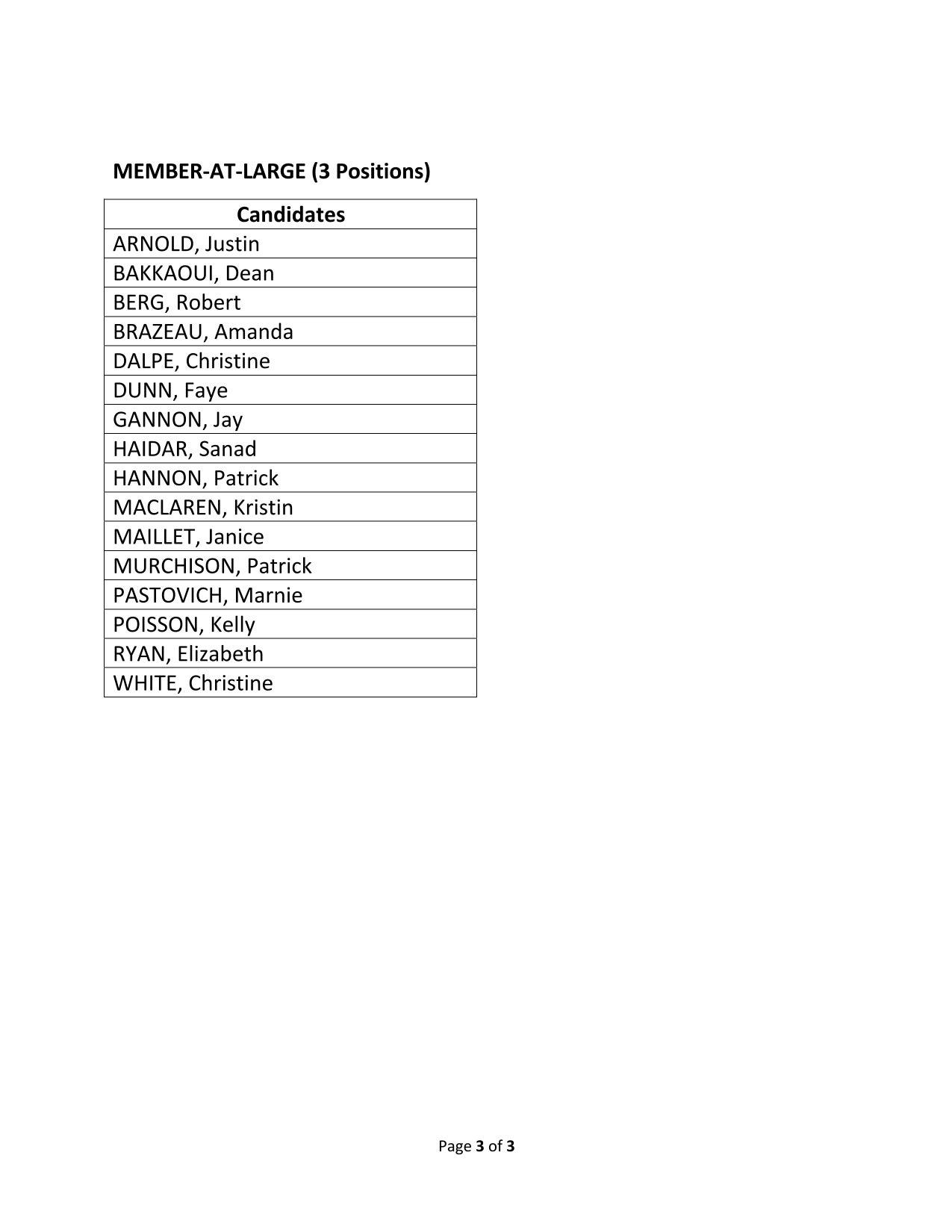

MEMBER-AT-LARGE (3 TO BE ELECTED) VOTES RECEIVED (50% PLUS ONE NEEDED TO WIN)

Jay Gannon 196 48.5%

Christine White 156 38.6%

Kristen MacLaren 108 26.7%

Patrick Murchison 96 23.7%

Marnie Pastovich 94 23.2%

Elizabeth Ryan 90 22.2%

Faye Dunn 68 16.8% (will be dropped from the next ballot)

Kelly Poisson has accepted the 2nd VP position, which means she is no longer a winning candidate for Member-at-Large. As no one received 50% plus one for the Member-at-Large position, the next Run-off Election Date for Member-At-Large will be Monday, July 13, 2020 from 8:00 a.m. to 8:00 p.m.

In solidarity,

Anne Dunning

Election Chairperson

CUPE 543

2020 CUPE 543 EXECUTIVE BOARD RUN OFF ELECTION RESULTS JULY 8, 2020

2020 CUPE 543 EXECUTIVE BOARD RUN OFF ELECTION RESULTS JULY 8, 2020

2ND VICE PRESIDENT (50% PLUS ONE NEEDED TO WIN)

Kelly Poisson 43.2%

Christine White 34.9%

Edward Charette 22.0% (will be dropped from next ballot)

VOTES CAST:

July 8 2020 410

MEMBER-AT-LARGE (3 TO BE ELECTED) VOTES RECEIVED (50% PLUS ONE NEEDED TO WIN)

410 VOTERS x 3 VOTES EACH = 1,230 VOTES CAST

Kelly Poisson 207

Jay Gannon 205

Christine White 179

Elizabeth Ryan 126

Kristen MacLaren 114

Marnie Pastovich 112

Patrick Murchison 106

Faye Dunn 94

Janice Maillet 87 (will be dropped from next ballot)

The next Run-off Election Date for 2nd VP and Member-At-Large will be Friday, July 10, 2020 from 8:00 a.m. to 8:00 p.m.

In solidarity,

Anne Dunning

Election Chairperson

CUPE 543

Election Runoff Results for 06 July 2020

Election Results for 26 and 29 June 2020. Runoff Date To Be Determined

2020 CUPE 543 EXECUTIVE BOARD ELECTION RESULTS

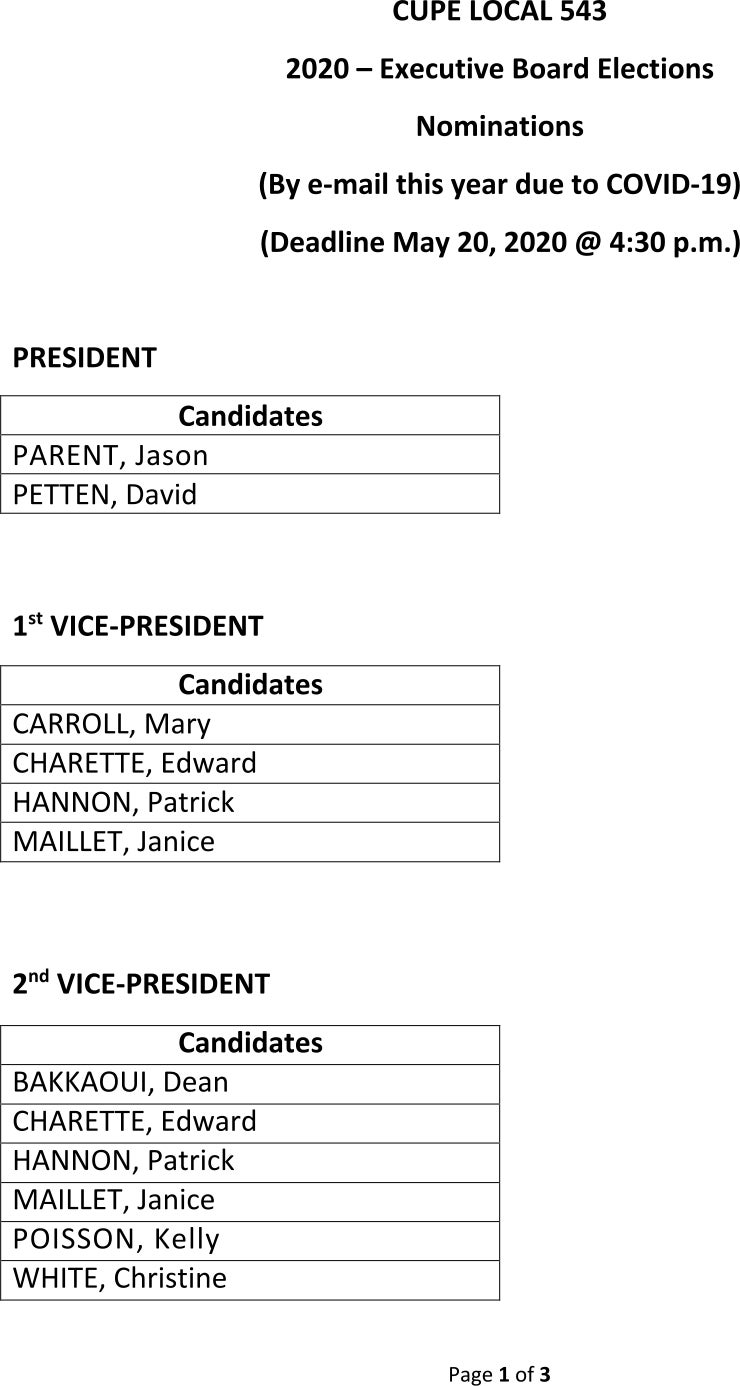

PRESIDENT

Dave Petten 68.5%

Jason Parent 31.5%

1ST VICE PRESIDENT

Mary Carroll 60%

Edward Charette 23.8%

Janice Maillet 16.2%

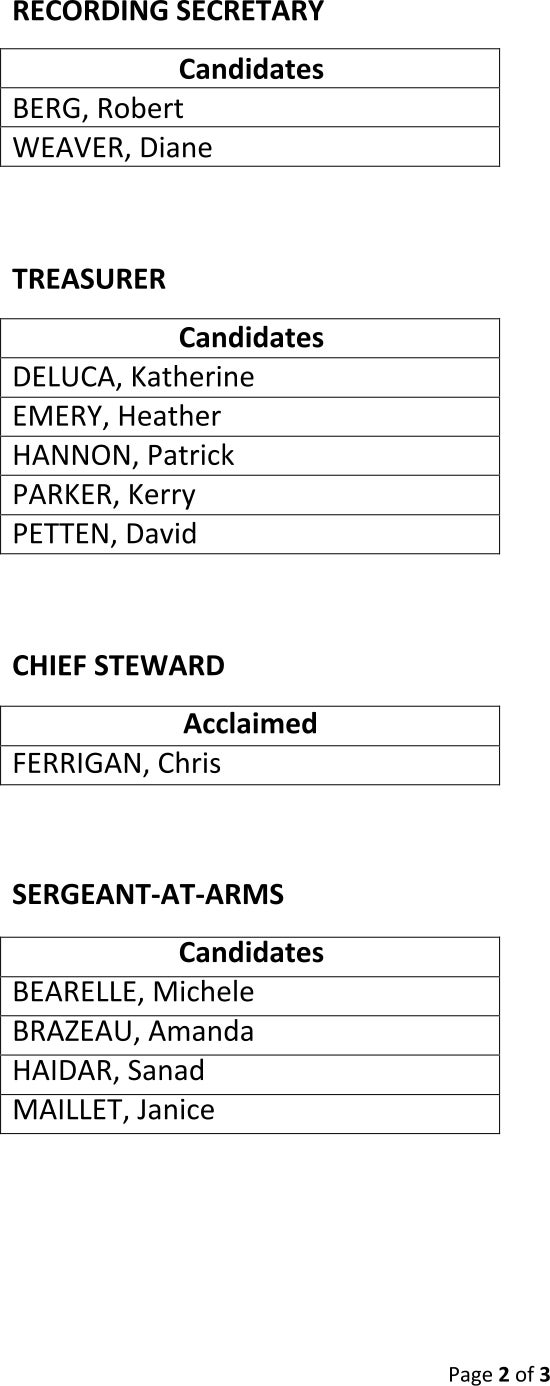

RECORDING SECRETARY

Diane Weaver 56.2%

Robert Berg 43.8%

RUN-OFFS

2ND VICE PRESIDENT

Kelly Poisson 31.3%

Christine White 28.5%

Edward Charette 18%

Dean Bakkaoui 12.1%

Janice Maillet 10.1% (will be dropped from next ballot)

TREASURER

Heather Emery 42.2%

Patrick Hannon 31.9%

Kerry Parker 25.9% (will be dropped from next ballot)

SERGEANT-AT-ARMS

Michele Bearelle 27.5%

Amanda Brazeau 25.3%

Sanad Haidar 25.1%

Janice Maillet 22% (will be dropped from next ballot)

MEMBER-AT-LARGE (3 TO BE ELECTED) VOTES RECEIVED

Kelly Poisson 184

Jay Gannon 181

Christine White 139

Marnie Pastovich 113

Kristen MacLaren 112

Patrick Murchison 105

Elizabeth Ryan 101

Amanda Brazeau 90

Faye Dunn 90

Janice Maillet 90

Christine Dalpe 58

Justin Arnold 57 (will be dropped from next ballot)

VOTES CAST:

June 26 2020 505

June 29 2020 440

Run-off Election Date will be announced shortly.

In solidarity,

Anne Dunning

Election Chairperson

CUPE 543

Membership Application

Dear Members,

In order to vote in the upcoming CUPE 543 election, a member must have been previously sworn-in. If you are a current 543 member and you do not have a membership card, please download and fill out the membership application, from the link provided below. Once completed, submit it and the $10 fee to the Local 543 union office, your steward, or executive board member as soon as possible. Any questions or concerns, please contact your representative or the union office at 519.254.3543

Temporary Pay Increase for Frontline Workers – Government of Ontario

As you are aware, the Government of Ontario has approved a temporary pay increase of $4.00 per hour for certain frontline workers. If you have been excluded from this temporary increase but believe you should qualify, you are encouraged to contact your local MPP as well as Conservative MPP’s in Government. Please click on the links below for contact information:

- MPP Contact Information – Government of Ontario

- MPP Lisa Gretzky -Windsor West

- MPP Percy Hatfield – Windsor-Tecumseh

- MPP Taras Natyshak – Essex

- MPP Rick Nicholls – Chatham-Kent-Leamington